You can also apply for a deferral if you’re in an area with intermittent or no internet connection.

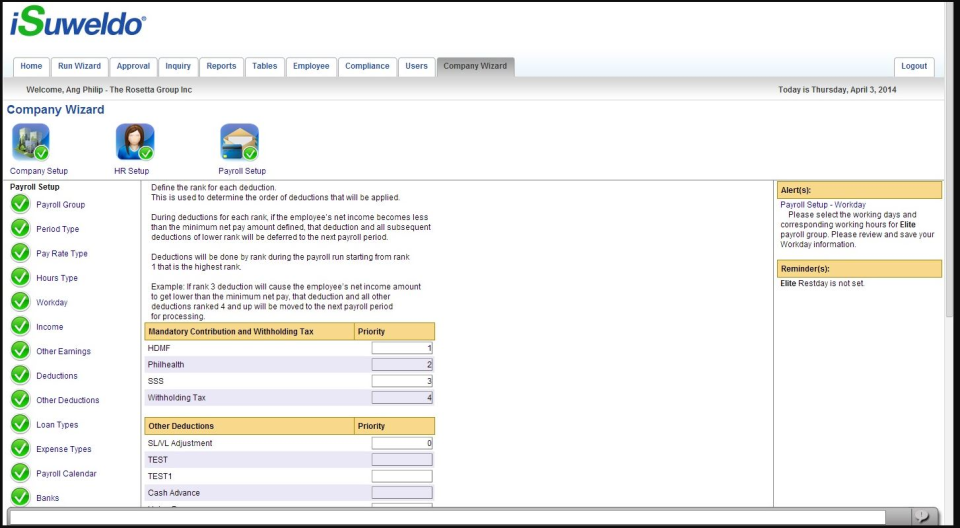

Payroll software for mac reviews software#

The ATO will consider deferrals if you are using customised payroll software and need time to configure and test it, for example. According to an ATO spokesperson "The degree of substantiation differs depending on what they state the reason is and how long they request the deferral to be." Which small businesses can defer STP reporting?Īny small employer can request a deferral if it needs more time to start STP reporting, but you have to justify why you should be granted one. If your business has 19 or fewer employees, it should have started reporting through STP by 30 September 2019 – unless you obtained a deferral from the ATO. 'closely held payees' such as family members of a family business, directors or shareholders of a company and beneficiaries of a trust.staff provided by a third-party labour hire organisation.

Payroll software for mac reviews professional#

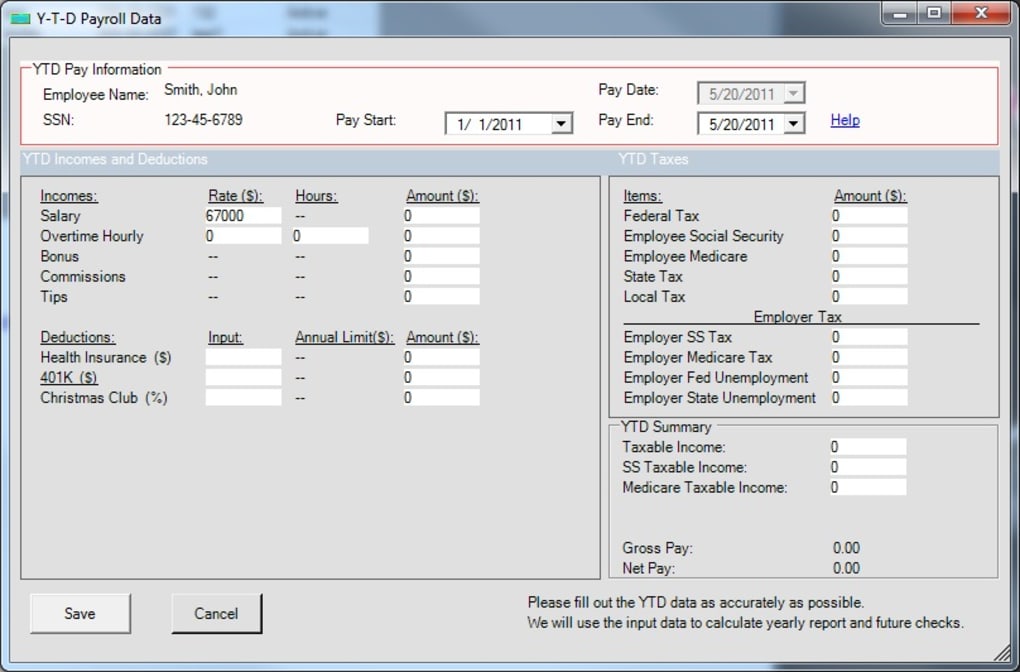

Keep in mind that the STP rules aren’t as simple as some sources suggest and this article doesn’t cover every aspect of STP reporting – so we recommend you seek advice from your tax professional or the ATO before making any decisions about STP, especially if your situation isn't clear cut. This article is intended to give you a summary of some of the issues to consider – and a guide to the key features of seven low-cost, standalone STP payroll software solutions for micro businesses. End-of-year processing just involves making a finalisation declaration.Īlso keep in mind that the ATO has stated that during the first year of STP reporting small businesses won’t be penalised for missing STP reports, submitting them late or making mistakes on them. STP should also save you time at the end of the financial year, because you won’t have to provide additional reports to the ATO or payment summaries to your employees.

In fact, it shouldn’t require anything more than an extra mouse click. Automatic reporting isn't difficult to set up and shouldn’t make payroll a more difficult or time-consuming task. And it’s likely to encourage some employers that weren’t using payroll software to start doing so.īut you shouldn’t see STP as a burden. That’s arguably one of the biggest accounting-related changes for businesses since the introduction of the Goods and Services Tax (GST) in 2000. We will not share your details with third parties. I have read and accept the privacy policy and terms and conditions and by submitting my email address I agree to receive the Business IT newsletter and receive special offers on behalf of Business IT, nextmedia and its valued partners.

0 kommentar(er)

0 kommentar(er)